If you’re borrowing money to meet personal or business requirements, it is important to pay attention to interest rates, the terms of your lender, and the general financial impact. Prime rates are a major aspect in determining how much loans and credit will cost. Understanding the prime rate can help when deciding whether to apply for business or credit cards.

The loan prime rate is commonly used by numerous lenders to calculate interest rates. PrimeRates makes lending easier by offering individual loan rates.

What is the Prime Rate? How Does It Work?

The prime rate is the interest rate that financial institutions offer to their most creditworthy clients, typically large corporations. The Federal Reserve’s federal funds rate determines the prime rate. When the Federal Reserve lowers or raises interest rates, it affects the rate at which the loan is primed. loan.

This rate is vital for borrowers because it forms the base of all lending products. Lenders usually provide a margin to prime rates depending on the creditworthiness of an applicant. The applicants with a favorable credit rating are given rates that are comparable to prime rates, whereas those with lower credit scores might be offered more expensive rates to cover the higher credit risk.

How do prime rates affect business loans

Getting a tailored business loan is crucial to finance expansions, buy inventory or manage cash flow. Prime rates directly impact the cost of a company loan, so it is crucial to know them prior to making a commitment.

Lower prime rates mean less borrowing costs. When the prime rate decreases the business loans will be much more affordable. The borrower can get funding at a lower rate of interest, which makes the perfect time to invest in the growth of your business.

Higher Prime Rates increase loan expenses – A rising loan prime rate will result in higher cost of borrowing. The monthly installments can be higher and affect the cash flow of businesses. Plan ahead for interest rate fluctuations is key to ensuring financial stability.

Credit Score Influences Loan Terms. Although the prime rate serves as an important benchmark to decide on the terms of loans, it varies on a borrower’s credit profile. Businesses with good financial records have better rates, for those with weaker credit scores might need to explore alternative funding options.

Prequalification could result in higher interest rates on loans. Instead of applying blindly and being rejected, loan applicants could be able to benefit from tools that will prequalify them based on their financial status. This will allow you to have an idea of rates that are available before submitting a loan request.

PrimeRates can help you find the perfect loan.

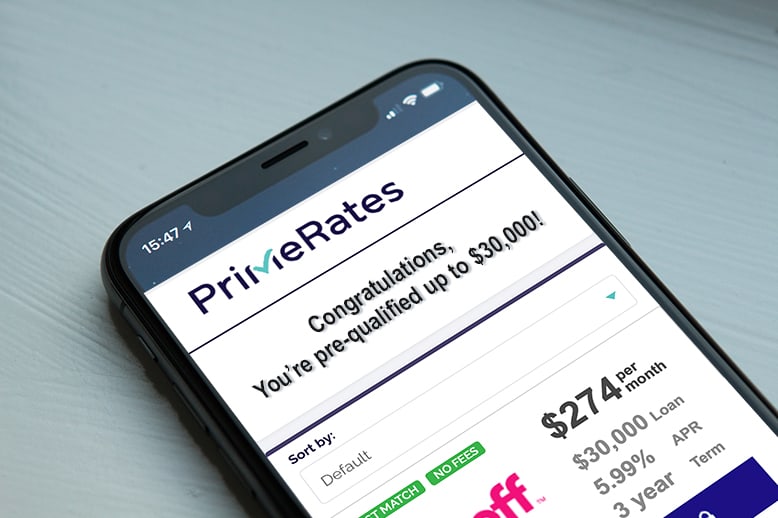

Comparing loans and understanding loan terms can be an exhausting process. PrimeRates simplifies this process through a platform that gives borrowers the chance to view personalized business loan offers without impacting their credit score.

Pre-qualification Process Simple – Applicants can receive tailored loan options based upon their financial requirements, by submitting basic details.

Transparent Comparisons of Rates – Instead of guessing what rates are applicable the borrowers can see actual offers.

Secure and reliable loans – Lender partnership gives access to low rates and flexibility in terms and conditions.

The Prime Rate and Business Loans Last thoughts

Understanding the prime rate when seeking a loan is crucial no matter if it’s for business expansion, to manage expenses or improve credit scores. A lower loan prime rate means more affordable borrowing options and a rising prime rate could impact the financial plan.

Instead of being left in the dark, loanees are able to make use of websites that provide transparent information about their loan eligibility as well as interest rates. Explore personalized business loan options via transparent lenders, ensuring access to financing options that align with the financial goals of the business.