Day trading is now a common strategy in financial markets. It lets traders benefit from the short-term shifts in price. Ninjatrader traders will achieve better trading success when they use the correct tools. This article examines Ninjatrader’s day trading signals strategies, systems, and indicators. It provides a comprehensive outline for novices and experienced traders.

Understanding Ninjatrader Day Trading Indicators

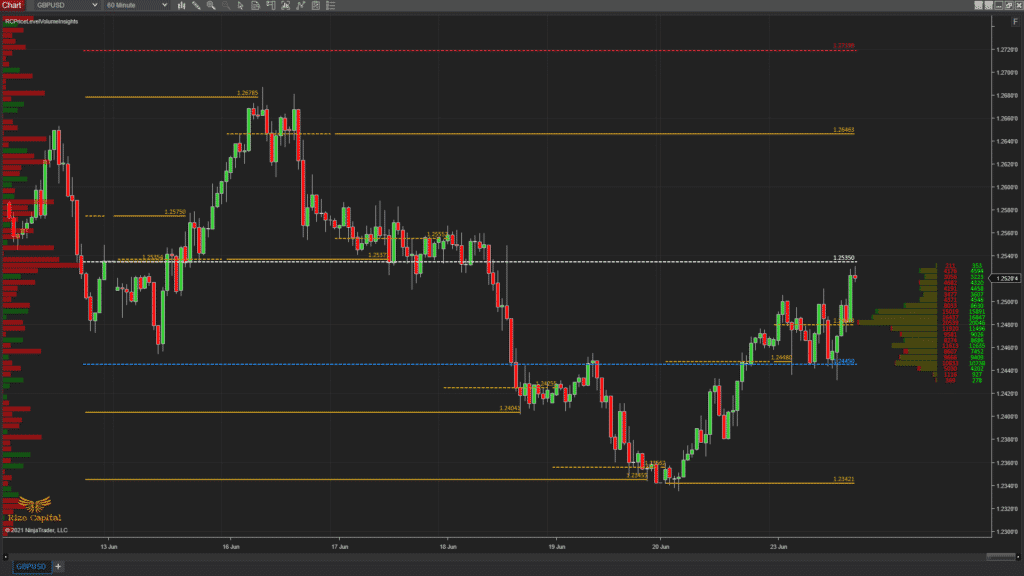

Ninjatrader’s day trading indicators aid traders make informed decisions by studying market data. The indicators are based upon various types of information, such as price, volume and time. Indices such as Bollinger Bands (Bollinger Averages) and the relative Strength Index (RSI), are very popular. Investors can make use of these indicators to identify trends, measure the volatility of a market, and identify the best entry and exit points.

To avoid information overload It is crucial for traders who are new to the market to start by using a couple of reliable indicators. Moving averages are an ideal starting point as they smooth out price data over time to highlight trends. When traders are more comfortable with their trading, they can add additional indicators to enhance their understanding.

The Function of Ninjatrader Day Trading Signals

Ninjatrader Day Trading Signals are created by Ninjatrader Based on predefined parameters determined by the trader. They alert the trader to possible buying or selling opportunities in the market. Signals can be based on an indicator alone or a combination of indicators, providing greater market analysis.

The ability of Ninjatrader’s software to automate signals is among its benefits for day traders. Automating signals can reduce the influence of emotions, and ensure that trades are conducted upon objective criteria. Traders can back-test their trading signals by using the historical data to evaluate their effectiveness prior to when they apply them to live trading.

Crafting Effective Ninjatrader Day Trading Strategies

To make consistent profits A trading strategy that works is vital. Ninjatrader day trading strategies range from simple to complex, depending on the level of experience of the trader as well as risk tolerance. One basic strategy may involve employing moving averages to detect trends and then using a stop-loss to reduce the risk. Advanced strategies may include the use of several indicators, complicated rules for entry and exit, and automated trades.

It is crucial to take into account the market conditions and the objectives of the trader when determining a strategy to trade day-to-day. Strategies should be able to change to market conditions. Because what works in a trending environment might not work in a broader market. Continuously reviewing strategies and making changes can aid in maintaining their effectiveness.

Building Robust Ninjatrader Day Trading Systems

Ninjatrader’s day trading platforms are complete strategies that integrate indicators as well as signals and strategies into a coherent framework. The systems can be fully automatic or manual. The trader can make trades using signals.

Automated trading platforms offer a range of benefits, including increased effectiveness, reduced emotional trading, as well as the capability to back-test strategies rigorously. However, they come with risks like system failures or unanticipated market changes. It is essential for traders to monitor their systems regularly and be prepared to intervene should it be necessary.

Day Trading Challenges: How to conquer them

Day trading, while potentially lucrative, does come with its own set of issues. The first-time traders may encounter difficulties due to unrealistic expectations about trading, the reliance on random indicators and emotions in decisions. To help new traders succeed it is vital to comprehend the market and to have realistic expectations.

Success in day trading is dependent on risk management. Risk capital is money traders are able to risk without risking their financial security. Position sizing, stop-loss order as well as other risk management methods can safeguard your investments and assist in reducing risk.

The significance of using high-quality trading Tools

It is crucial for traders to have access quality tools to trade for day trading. IndicatorSmart provides Ninjatrader indicators as well as systems, signals and indicators designed to provide traders the highest quality resources. These tools will enhance your market analysis and decision-making process and will lead to better trading results. Click here for Ninjatrader Day Trading Systems

Also, you can read our conclusion.

Ninjatrader provides day traders with an extremely powerful platform that comes with various tools and features to help them improve their trading. By understanding and utilizing Ninjatrader day trading indicators such as signals, strategies and strategies, traders are able to build a complete understanding of the market. Day trading success requires constant learning, adapting, and efficient making use of resources. With the right tools and mindset traders can overcome the difficulties of day trading, and also reach their financial objectives.